Why to use our debt collection services?

- Will provide you with debt collection services, we have full scale sources of information and experience in the field of debt collection.

- Will transfer debt collection to the specialists of this field, so you can concentrate on the company's core business management and development.

- Will accelerate business return of funds and increase cash flow.

- Will reduce debt collection and recovery costs, and increase efficiency of the debt recovery.

- Will assist in avoidance of possible errors often occured due to the lack of practice, or late decisions, and prevent formation of the new debt.

- Will have well maintained business relationships with customers in debt.

Pre-debt collection

Creditor

In order to obtain an effective debt collection results, we carry out ethical and lawful actions to the business activities:

- collection of information about the debtor (a detailed statement of the debtor);

- receivables debt settlement plan;

- negotiations with the debtor and payment scheduling;

- continuous monitoring of the borrower's behavior in relation to solvency;

- prompt information provision to the customer about the debtor's actions and the work with the borrower report;

- recommendations on debt repayment: forced pledge, lien, assignment of creditor's claim transfer contract formation, and other acts provided by the law in the examination of the individual situation of the debtors;

- recommendations if exhausted other methods: debt recovery case to the court or write off;

- placing bad debtors on SAIS information system.

Debtor

We can assist You

- we provide consultation and mediation services to your creditors;

- we provide consultation and mediation service by signing promissory notes or other payment guarantees to your creditors;

- we represent you in negotiations on the debt with your creditor.

Borrowers solvency assessment

Evaluate potential or current borrower's status, so knowing this You can effectively plan billing and debt collection policy for your company.

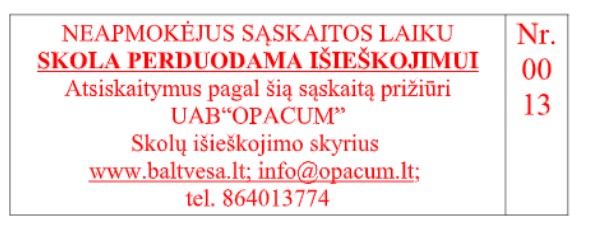

Control stamp for invoices

Naturally, in business relationships often customers become indebted to each other, so as a preventive debt formation instrument we use the control stamp for invoices* which points out that the debt settlement process is controlled. This stamp is recommended as a reliable and proven debt-prevention tool, because with it marked the account is sent to current or new customers.

*The stamp informs that the settlement process is controlled. It states that if payment is not processed in time, as a debt will be transferred to our company‘s special department for debt collection.